Data Analytics

Data Analytics Does Your Data Work for You?

One undeniable result of today’s digital environment is that we now find ourselves immensely and overwhelmingly surrounded…by data. Forward-thinking offices are turning their analysis inwards, using data to track and improve procurement performance. How are you using the data your office collects? Pulse is here with a look at 3 award-winning examples of how data can work for you.

Michigan and the Unrealized Transformative Power of Internally Focused KPIs in Public Procurement

Key performance indicators (KPIs) are a mainstay in the private sector and are gaining traction in public procurement. After a self-evaluation, Michigan’s Central Procurement Services (CPS) developed new strategic goals to improve performance. Aligning KPIs with goals of public procurement may seem simple on the surface: measure cost savings and customer satisfaction. While useful, these are lagging indicators that look at past performance and are not predictive of future performance. CPS paired these with a set of leading indicators to create a more comprehensive view of efficacy for every service area they provide. Some of the KPIs that Michigan CPS uses to measure performance include:

Realized fiscal savings

Net promoter scores (NPS)

Compliance with service level agreement (SLA) timetables (a leading indicator of customer satisfaction)

Employee attrition rate (a leading indicator of both savings and customer satisfaction)

Average supplier performance rating (a leading indicator of customer satisfaction)

Response time for agency customer requests and FOIA inquiries

To ensure that all staff participates in the process, the data used for KPIs is gathered directly from employees’ work within Michigan’s central database. This centralized system allows buyers and their managers to view their personal performance against the KPIs at any time. Large screens in the front of the office show current results and trends. CPS also generates quarterly agency-specific and aggregated reports to document the office’s performance for its agency customers.

The first year of implementation saw immediate improvements for CPS. Requests for Proposals meeting their SLA targets increased from 25% to 62%. NPS increased from 60 to 75. Meetings with agency customers for reviewing complaints and grievances decreased. Satisfaction with, and the overall perception of CPS improved throughout state government. Their KPIs provide opportunities for continuous process improvement by quantifiably identifying areas of weakness and providing evidence and justification for changes to policy, process, or priorities. Consequently, they can allocate time and resources to improving those areas more efficiently.

To learn more, you can read the full project submission or watch this webinar. This project received the Bronze Award at NASPO’s 2018 George Cronin Awards for Procurement Excellence.

Florida’s Market Analysis and Procurement Strategy (MAPS)

Our next example combines market research data gathering with past spend and usage trends to identify present and future needs and inform procurement methods. Florida’s Department of Management Services (DMS) created the Market Analysis and Procurement Strategy (MAPS) process to identify the optimal procurement methods to achieve best value for the state. MAPS is used to determine whether to issue a new competitive solicitation, re-solicit an existing contract, renew an existing contract, or allow an existing contract to expire.

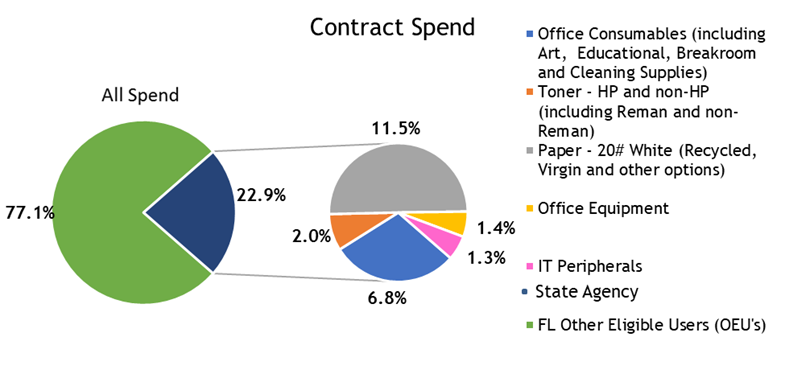

Example of the Office Supplies MAPS comparing spend by product category and by customers.

The data compiled in MAPS portfolios include:

Market research reports from databases including Procurement IQ and GovWin

Prior state contract spend and vendor sales reports from MyFloridaMarketplace

Agency usage and feedback

Pricing analysis comparing similarly sized states, neighboring states, nationwide cooperatives, and GSA schedules

Risk Assessments